From budgeting babies to balancing car payments, students get a crash course in adulthood — with a little laughter along the way.

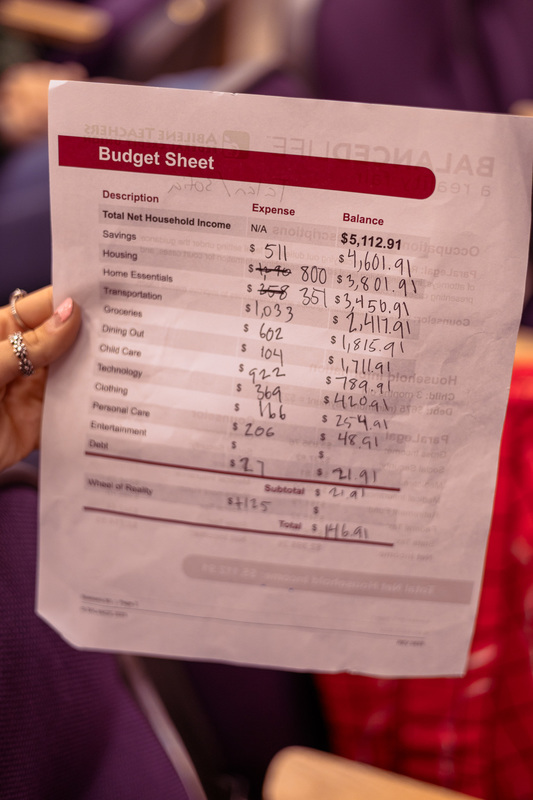

By midmorning Wednesday, the Performing Arts Center at Wylie High School had transformed into a bustling scene of real-world decision-making. Tables labeled “Housing,” “Transportation,” “Childcare,” and “Savings” filled the space as local professionals met with seniors to talk through the costs of everyday life. Students compared notes, recalculated budgets, and laughed in disbelief as they discovered how quickly their mock paychecks could disappear. It was all part of the school’s annual Reality Fair — a hands-on financial literacy event designed to show what it really takes to live on their own.

This year’s Reality Fair, organized by Elizabeth Gray of Abilene Teachers Federal Credit Union, brought together nearly a dozen community partners and the entire senior economics class. The goal: help students apply what they’ve learned in the classroom to a life-sized simulation of the real world — from managing paychecks to choosing cars, homes, and even how many children to “have.”

“This is my third time to help with the Reality Fair, and I just think it’s fabulous,” said Wylie ISD Board of Trustee member Laura Donaway, who volunteered at one of the stations. “These kids have no idea — they’re living in this senior world right now, and they don’t realize you have to eat every day, buy clothes, and pay for housing. It’s very eye-opening but also very practical. I think it’s one of the best programs we do.”

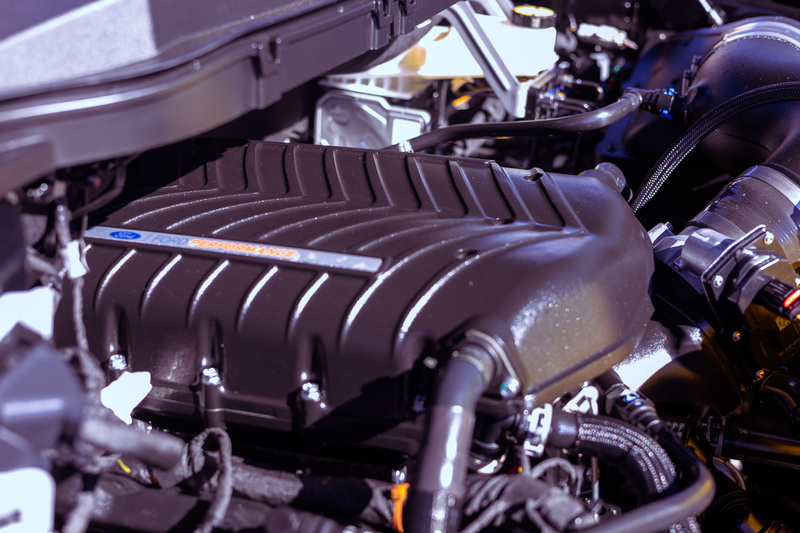

Lessons in Horsepower and Humility

Out behind the PAC stage, students gathered around a bright black Ford F-150 that gleamed under the morning light.

Representatives from Arrow Ford had brought the truck as part of the event’s vehicle maintenance breakout session. But this wasn’t just any pickup — it packed a Whipple supercharger, pushing more than 700 horsepower.

“A few students were quick to spot the supercharger right away,” said Drew Holland, Arrow Ford’s representative. “They knew exactly what it was — one even asked if it was tuned for performance. But once we started talking about maintenance, fluids, and tire costs, it got real pretty fast. We want them to see that it’s cheaper to maintain a car than to replace it — and that you can’t just buy for style, you have to plan for the upkeep.”

As students examined the truck, others asked about oil changes, tire wear, and — yes — the cost of gas for something that powerful. “It’s fun to get them excited about cars,” Holland said. “But it’s even better to help them connect that excitement to responsibility.”

Senior Isaac Byamung smiled as he left the vehicle station. “It’s been fun, but it definitely opened my eyes,” he said. “I was surprised how expensive things are — especially kids and transportation. I’d like to have a sports car one day,” he laughed. “But I’ll try to keep it practical.”

A Day of Dollars, Decisions, and Discovery

Inside the Blackbox Theater, the team from Texas State Technical College (TSTC) led sessions on total compensation — the concept that a paycheck is only one piece of what employees earn.

“A lot of them are shocked to find out how much benefits really matter,” said Erin Wilhite, TSTC’s manager of employee relations. “They’re used to thinking in terms of hourly pay, but once we start talking about healthcare, PTO, and retirement, the light bulbs go off. They start realizing there’s so much more to a job offer than just the salary.”

Wilhite said her favorite part of the day is watching students connect those dots. “At TSTC, our entire mission is helping students find well-paying jobs,” she explained. “So getting to talk to them about their futures at this age is so rewarding. This event fits perfectly with what we do — it plants those seeds early.”

Meanwhile, down the hall, the Choir Hall echoed with cheers as teams of students played a Jeopardy-style game about credit and savings. Questions about interest rates, loans, and credit scores drew some groans — but also a lot of learning.

“They’re engaged, laughing, and competing,” said one volunteer. “But they’re also starting to realize that every choice affects their future. It’s a lot to process — and that’s exactly the point.”

Senior Jack Carrington said the Reality Fair was more than just a classroom activity — it was a lesson he knows will stick. “It is very beneficial for my future,” he said, looking over his completed budget. His fellow senior Rebecca agreed, saying the experience made the realities of adulthood hit home. “It gives me a peek into my future and how expensive children are,” she said with a smile, shaking her head at the costs listed on her worksheet. Like many students, both walked away with a new appreciation for just how quickly a paycheck can disappear once real life begins.

Budgeting Reality: “We Had to Move”

For seniors Sophia Valdez and Riley Purcell, the exercise hit especially close to home.

After tallying up their mock income, the pair thought they were in good shape — until childcare entered the picture.

“Kids are very expensive,” Sophia said with a laugh. “And tires — tires are really expensive, too.”

Riley nodded. “The cheapest childcare we could find for a three-month-old was $922 a month,” she said. “That changed everything. We had to downgrade our housing, but we made it work. We still had $1,111 left over, so we were proud of that.”

The two budgeted carefully, saving a little for outdoor fun like hiking, setting aside $155 for entertainment, and even adopting a pet. “It’s been entertaining and stressful at the same time,” Riley added. “But it really shows you how fast money disappears.”

Their favorite stop of the day was the “Spin the Wheel” table — a game of chance where students could gain or lose money based on real-life events. “You could land on something like a vet bill or get a bonus,” Sophia explained. “They handed us envelopes, and I didn’t even realize there was real cash in them until someone told me. It was like playing Monopoly, but with actual consequences.”

Trustees Take Notice

Among those watching students navigate their mock lives were members of the Wylie ISD Board of Trustees, including Cameron Wiley, who joked that he might need a refresher course himself.

“Well, like I said, I’m probably the last person to take hygiene advice from,” he laughed, standing near the health and lifestyle booth. “But seriously — this is good stuff. I wish I’d had this in high school. You introduce it early so kids can see how life really works once they leave school and start their careers. Honestly, I think even some adults could benefit from this. These are life skills that stick with you long after high school or college. It’s important to plant that seed now.”

Wiley’s point wasn’t lost on the teachers guiding their groups from station to station. Many said the fair gives their seniors a rare chance to see how the lessons of economics play out beyond the classroom — with immediate and personal impact.

Planting Seeds for the Future

Organizer Elizabeth Gray smiled as she surveyed the busy room, where laughter mingled with serious budgeting talk. “That’s the moment we look for,” she said. “When students go from ‘This is fun’ to ‘Wait, I can’t afford that.’ They start thinking about trade-offs, and that’s when learning becomes real.”

Gray said she’s grateful to the volunteers and community partners who make the event possible each year. “They give their time to help students understand life in a way we can’t teach in a textbook,” she said. “Wylie was the first district to partner with us for a Reality Fair back in 2019, and it’s still one of the most enthusiastic. We’ve missed only one year — during the pandemic — and every time we return, it grows stronger.”

By the end of the morning, students turned in their budget sheets and compared final balances. Some had savings left over. Others — a little more “in debt” than they’d planned — walked away with new appreciation for their parents’ grocery lists.

And nearly everyone agreed: life is a lot more complicated than it looks on paper.

“It’s one thing to learn about budgeting,” said another senior. “It’s another thing to actually feel what it’s like to run out of money. It makes you think differently about the future.”

A Lesson That Sticks

As students filed out for lunch, board members and volunteers reflected on what they had seen — teens who came in curious and left a little wiser, with a few good laughs along the way.

“This kind of event stays with them,” Donaway said as she packed up her booth. “They’ll remember the day they learned that kids cost nearly a thousand dollars a month and that tires don’t last forever. Those are lessons that matter.”

The Reality Fair may only last a few hours, but its impact reaches far beyond the PAC doors. For many of these seniors, it’s their first glimpse of the financial choices that await them — and a reminder that responsibility, like budgeting, takes practice.

And if the laughter that echoed through the halls was any indication, Wylie High’s Class of 2025 is learning that growing up doesn’t have to be scary — it just takes planning, perspective, and a little bit of humor.